Avoiding any of the politics and emotive elements of this particular issue, in many ways I have to endorse what the Public Service Union and the Association of Public Service Senior Managers (APSSM) have decided to do: that is, defer their pay raise/adjustment given the distressed state of the Belizean economy.

Currently, the entire global outlook is less than optimal. One could pick from any reputable source for macroeconomic forecast and the story remains the same: the outlook for Caribbean economies “remains fragile”.

For example, the International Monetary Fund (IMF) 2016 Regional Economic Outlook (Western Hemisphere) put it this way: “With the global economy still struggling, many countries in Latin America and the Caribbean are facing a harsher world than they did just a few years ago.” (See IMF report here)

Scotia Bank’s Caribbean Regional Outlook stated: “The Caribbean economic outlook remains fragile. Growth prospects for 2016 are relatively muted and subject to considerable downside risk given the region’s vulnerability to external demand shocks and internal challenges.” (To see Scotia Bank’s Report Click Here)

The most frequently cited exogenous risks include (1) the potential effects of Brexit, (2) the potential effects of a Zika outbreak on travel spending, (3) the slowdown in emerging market economies such as China, (4) weak commodity prices which have already negatively affected local sugarcane farmers and Belize Natural Energy (BNE). In the midst of all of this, there remains (5) the increased tightening of financial regulation among which is the notorious “de-risking” phenomenon; (6) there’s the usual concern about natural climatic and weather-related factors.

The current strength of the U.S. dollar (and to some degree the lower energy prices are) among some of the factors that have led some to forecast positive growth in tourism this year. So this may be one bright spot. It’s no surprise, then, that while our local Primary and Manufacturing sectors have seen contractions by 26% and 3.5% in this year’s second quarter, the services sector–within which tourism is an important player–saw overall growth of almost 4%.

In the words of the IMF:

“Growth prospects are deteriorating for commodity-based economies. …Suriname and Trinidad and Tobago are most affected because they depend on exports of fossil fuels and other commodities whose prices are falling rapidly. For Belize and Guyana, however,

positive offsets from other parts of the economy—tourism in the former and oil imports in the latter—dampen the negative impact.”

Belize-specific issues

Add to this regional scenario some Belize-specific issues such as the bacteria that affected the Shrimp Industry, the compensations for the two nationalised utility companies, the loss of Meridian Limited (Maya King), and more, including the recent damages for Hurricane Earl–which if we may underscore occurred in August and was not factored into the Second Quarter figures–paint a pretty worrisome picture.

Now, one could argue that government should have used Petrocaribe monies to do more than just road infrastructure and sporting facilities. This type of argument is not without its merits; however, those raising this point would need to be wary of over generalising, because long-run aggregate supply (growth in output) can depend on the state of a country’s infrastructure (roads, communication and transportation). The question best debated would be which category of infrastructure development is/was most needed so as to help reverse some of the aforementioned downward pressures.

Among other long-run supply-side issues, there is the level of human capital and productivity, the degree of domestic investment in export-oriented production, inflation, and labor costs. Time doesn’t permit for a full elaboration on these long-run factors, except to say that there’s a reason why they are described as “long-run”. They take time to achieve.

Regarding labor costs, this might seem surprising to some, but when Belize’s minimum wage is looked at relative to its income level (per capita GDP) a 2014 study on Belize’s Labor Market, conducted by David Linduaer, found that Belize’s ratio of annual minimum wage to GDP per capita ranked as the fourth highest out of the 15 countries looked at in the study (see page 21 of said study).

Nonetheless, the above cited study and others like it, including the World Bank’s Enterprise Survey, show that the unit labor costs are not likely to be the biggest concern for the private sector; on the other hand, the skill level of our workers apparently is a little bit more of an issue.

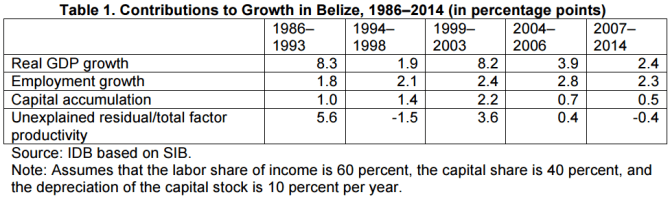

The fundamental truth is this: the level of human capital, among other things, can have a direct effect on a country’s level of productivity. While measures of total factor productivity (TFP) are not without controversy, it can be relatively useful, nonetheless. In 2015, in a study entitled “Rekindling Economic Growth in Belize“, author Dougal Martin presented data on how TFP relates with other sources of growth.

The fundamental truth is this: the level of human capital, among other things, can have a direct effect on a country’s level of productivity. While measures of total factor productivity (TFP) are not without controversy, it can be relatively useful, nonetheless. In 2015, in a study entitled “Rekindling Economic Growth in Belize“, author Dougal Martin presented data on how TFP relates with other sources of growth.As can be seen in the table above, productivity levels are not the best, serving to help depress growth even when there’s capital accumulation and growth in employment. This could lead us to another supply-side matter: low domestic investment. If productivity levels are low, this could dampen incentives for further investment; consequently, this is an area that is worthy of closer attention.

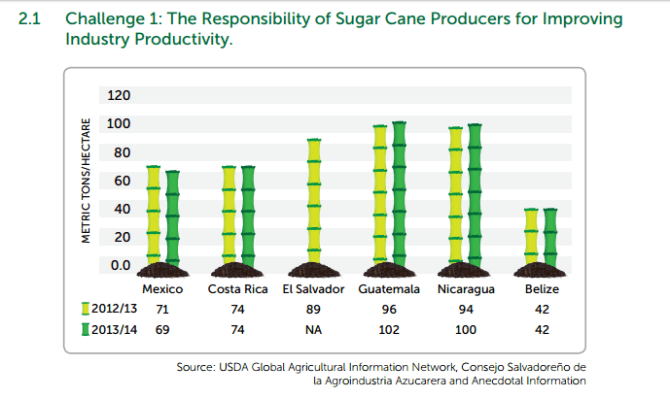

This productivity issue was raised, for example, in the Belize Sugar Industries (BSI)’s recent strategic plan. As shown in the image excerpt above, for both the 2012/2013 and the 2013/2014 crops Belize’s output of sugar cane per hectare averaged about 42 metric tons (approximately 17 metric tons per acre), while for both crop years all other countries looked at averaged above 69 metric tons per hectare.

This productivity issue was raised, for example, in the Belize Sugar Industries (BSI)’s recent strategic plan. As shown in the image excerpt above, for both the 2012/2013 and the 2013/2014 crops Belize’s output of sugar cane per hectare averaged about 42 metric tons (approximately 17 metric tons per acre), while for both crop years all other countries looked at averaged above 69 metric tons per hectare.Now, to be fair, the 2015/2016 crop has definitely made improvements, as was reported in the media recently, with BSI reportedly surpassing its own target for this year. And with the advent of the Santander Group in the west, Belize’s sugar is one of the few sectors that reported positive growth of 24% for the second quarter. This is “due to an earlier start to the crop season as well as the addition of a new producer in the Cayo district”, SIB reported recently. The issue facing this industry, however, is not the output levels per se; it is the downward trends in world-market prices.

Back to Salaries

The point here is this: while no one would deny that educators deserve a raise (heck I’m one who would benefit from such an increase, given that I’m an educator myself), the inescapable truth is that the Belizean economy falls within regional and domestic environment that speaks to struggled growth.

On the most optimistic terms, annual growth for 2016 may meet the IMF’s forecast of 0.5% growth; however, that is dependent on how well sectors such as shrimp, for example, make a rebound, and whether or not the expected growth in tourism is realised despite the Zika issue. Not to mention the ongoing “de-risking” debacle.

Belize already has a significantly high wage bill. It has been a concern from as far back as the Esquivel Administration in the early 1990’s. As reported in a 1996 World Bank study, by 1994-95 fiscal year, the wage bill was already 12% of GDP at $132 million. Back then the word that got everyone riled up was one that Eldred Neal, president of the Public Service Union (PSU), used in an interview with the media this week: “retrenchment”.

If growth is declining, it is expected that government will have less tax revenue to work with. If government is committed to not letting anyone go out of the public service (we all saw what that did back in the Esquivel era), then this leaves the options of more borrowing or an increase in consumption tax on the table.

With a debt-to-GDP ratio already above 80%, is borrowing really what we would champion? And any increase in General Sales Tax or, let’s say, an increase in the tax on fuel, once again, would lead to their own socioeconomic and political backlashes. Moreover, we already saw the bus operators trying to raise rates, what do we think they’d demand if fuel is hiked again? After all such a move directly affects cost of transportation.

All Things Considered

Of course, no one is saying that the teachers do not deserve a raise. Actually, no one is saying that anyone in the public service is undeserving of the salary adjustment. It is a question of timing.

On the one hand, people are going to be calling on the government to increase operations and maintenance spending, especially regarding needed infrastructure, while it has to meet higher wages. The latter has been known to crowd out the former.

Some quarters, however, have called on government to become more efficient in terms of public expenditure. This we all could agree is necessary. The deferral could be used as leverage for the government to increase the political will on fixing those areas of wastage as it pertains to public expenditure.

But, in an economy that may be looking down the barrel of at best an optimistic 0.5% growth for this year, the conversation should be more about how do we begin addressing those supply-factors that are in our control. I side with those who put to the productivity factor in the forefront. The Belizean economy along with the rest of the region need to find ways to improve our level of productivity and innovation.

If we’re talking innovation and increased productivity (and/or efficiency), then the last thing we’d want is any thing that suggests higher taxes or duties, especially on needed inputs in the production process. And any borrowing could be looked at as deferred taxes, which will be collected at some point in the future. Instead, the goal would be to reduce any crowding out effects that currently exists.