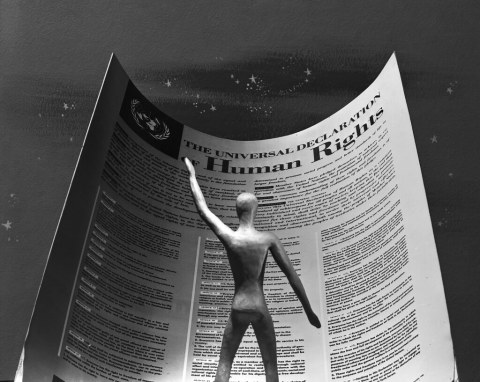

We knew it was coming for months, but there’s something in the actual tabling of the People’s Constitution Commission Bill, 2022, that has brought the point home: Belizeans are, in fact, about to embark on a journey to revise our Constitution.

The functions of the Commission are fairly straightforward and delineated in section 6 of the Bill: (a) Conduct a comprehensive review of the Belize Constitution, and (b) prepare and submit to the Prime Minister a final report on its findings of the review.

As is to be expected, the Commission is also expected to carry out this work in a predominantly consultative fashion. For its part, the Bill adds, “For the purpose of sub-section (2) [which addresses how the Commission should go about this work], the Commission shall afford the people of Belize, both within and outside the country, to the extent practicable, the opportunity to freely express their opinions and make suggestions on matters they feel should be considered in the Constitution.”

This is good. This type of process should be as broad-based and as consultative as possible. Of course, this also means that the Commissioners’ work will be cut out for them, given that broad-based also signals wide-ranging and disparate views on what should remain and what should change within the Constitution.

BASIC CONSTITUTIONAL PRINCIPLES

Now, whatever the recommended changes will be, there are at least five principles that are likely to be enshrined in a democratic country’s Supreme Law: (i) Individual Rights, (ii) Popular Sovereignty, (iii) Separation of Powers, (iv) Checks and Balances, and (v) Limited Government.

The first is somewhat self-explanatory, as this speaks to the protection of the fundamental rights of every citizen. Part II of Belize’s Constitution covers these rights, which include the right to life, freedom, protection from inhumane treatment, and protection of your freedom of movement.

The second principle, Popular Sovereignty, is what gives us our representative democracy, as it is understood that governmental authority emanates from the people. It is for this reason the Constitution protects the “voice” of every voter.

Separation of Powers is also enshrined in the Constitution by way of the three branches of Government: The Legislature, Executive, and Judiciary. Of course, in a Parliamentary Democracy, there is often criticism surrounding the blurred lines between the Legislative and Executive arms of government.

Limited Government speaks to the fact that powers of government should be curtailed by the Supreme Law. From the vantage point of the rule of law, the prime minister and no other member of government can be deemed to have unlimited powers or “above the law.”

Finally, we arrive at the fifth principle: Check and Balance. I saved this one for last, as this principle is the primary focus of this Res Publica360 entry. Fundamentally, Checks and Balances are systems designed to keep the various branches of government in line. The Legislative branch, for instance, is to oversee the executive.

BACKBENCHERS: BUILT-IN CHECK & BALANCE?

One form of check and balance (CnB) that is seldom discussed in Belize is the so-called “backbenchers” role in Parliament. Remember what I had said above: The Legislative arm is intended to oversee the executive’s policies. This job should not only fall to the Opposition but also to these backbenchers.

Let’s use present-day examples. Currently, the People’s United Party (PUP) makes up the majority, with its members holding 26 out of the 31 seats in the House of Representatives. And, given our system, the members of the Cabinet, led by the Prime Minister (who is the leader of the majority party), are likewise made up of persons from among that 26.

By definition, backbenchers are members of Parliament who are not members of the Cabinet and are supposedly free of the so-called “payroll vote.” But that’s a fairly narrow definition. The Institute for Government, a think tank, uses a much more liberal definition when discussing the “payroll vote:”

“The term ‘payroll vote’ has traditionally been used to describe MPs [members of parliament] who hold positions from which they would have to resign in order to oppose the government. This includes paid and unpaid positions. The term can also include roles which do not formally bind MPs to vote with the government, but may have been given out by the prime minister in order to reward or encourage loyalty. This is the wider payroll vote.“

Did you “hear” that? These paid (or unpaid) positions may “bind” Members of Parliament “to vote with the government.” And there you were, thinking that at least those non-Cabinet ministers were free to vote according to the needs and wishes of their constituencies or, at least, their conscience. Sorry.

Elliott Bulmer (2017)’s work, entitled “Government Formation and Removal Mechanisms,” does an excellent job of summarizing how authorities have worked to dilute the ability of backbenchers to be free enough to challenge their own party’s policies. Bulmer (2017, p. 35) states:

“The doctrine of collective responsibility means that ministers cannot vote against the government in parliament…The ‘payroll vote,’ as it is called (because ministers are on the government’s payroll), can be very influential in securing the loyalty and obedience of backbench parliamentarians. Governments may attempt to appoint oversized cabinets, or a LARGE NUMBER OF JUNIOR MINISTERS, to increase the influence of the payroll vote. As well as weakening parliament, this tactic can lead to a bloated inefficient government.

“To prevent this, some constitutions place limits on the number of ministers that may be appointed and hold office at any time. The Constitution of India (article 75), for example, restricts the number of ministers to 15 per cent of the total number of members of the lower house.”

BELIZE’S CONSTITUTION AND THE PAYROLL VOTE

As Bulmer (2017) highlighted, prime ministers in parliamentary democracies have an incentive to effectively purchase obedience and loyalty from their party folks; thereby, minimizing the possibility that non-Cabinet members of his own clan could too easily challenge the Cabinet’s policies.

[It is worth keeping in mind that Belize’s Constitution—since the last Constitutional reform—has anti-defection provisions which prevent “crossing the floor,” which is yet another source of protection for the prime minister of the day. But anti-defection is a topic for another time].

The Belize Constitution tries to defend against the payroll vote in section 40(2), which states:

“Provided further that the CABINET shall be comprised of, (a) not more than TWO-THIRDS of the elected Members of the party that obtains the majority seats in the House of Representatives following the holding of a general election.”

Keeping with the current majority, that provision limits the PUP to about 17 ministers. And, of course, the administrations—past and present—have done well to satisfy that part of the law.

So, in theory, all things being equal, at least nine members of the PUP majority in the House of Representatives should be free of the payroll-vote noose. And, where necessary, these free men and women could call—if even politely—their own government colleagues back into alignment with sound public policy.

But, of course, as pointed out by Bulmer (2017), this fairly weak proviso in the Supreme Law leaves the door open to Junior Ministers, or what is often called “Ministers of State.”

How so? Section 40(2) of the Constitution considers only Cabinet members, but as section 44 of the Constitution makes plain, a “Minister of State…SHALL NOT be a member of Cabinet.” So, there you have it. Junior Ministers are paid from the public purse, and, therefore, whatever little flicker of criticism that could have emerged from the backbench is muffled by the expanded payroll vote. And here’s the kicker! Under the current language of Section 40(2) of the Constitution, it’s perfectly legal!

AMENDING SECTION 40(2)?

Okay. So this brings us full circle. I started this off by talking about the basic principles governing any democratic Constitution. As we move into the Constitutional reform process with those principles serving as guiding lights, the Belizean people—among many other things—will also have to examine the strength (or lack thereof) of these so-called check-and-balance institutions.

If we borrow from the criminologists’ “broken window” concept, we could say that we ought not to let even the smallest crack in our oversight mechanisms go unattended. The payroll vote is one such small crack.

Consequently, as we move towards this extensive exercise of reviewing the Belize Constitution, this is one area that is worthy of our attention. And it should force upon us this question: Should section 40(2) of the Constitution be amended to include not only Cabinet members but also any paid government office to which a Member of Parliament could be appointed, with the expressed goal of limiting the payroll vote?

We shall see where this issue lands on the reform agenda. For now, it could only be hoped that it will all boil down to a matter of principle for most of us.